Implementing a Proactive Fiscal Policy

In 2023, China’s economic aggregate exceeded 126 trillion yuan, showing an increase of 5.2%, and once more making China the largest engine of global growth. Revenue in the national general public budget reached 21.68 trillion yuan, an increase of 6.4%; expenditure was 27.46 trillion yuan, registering a growth of 5.4%. At the same time, however, we also encountered difficulties and challenges in consolidating the overall trend of recovery and growth in the economy. Some of these issues resulted from risks and problems that had built up over many years. Others were temporary pains, including a lack of effective demand, which were caused by structural changes in our economy. Yet others came in the form of new challenges arising from changes in the external environment. At the Central Economic Work Conference in December last year, it was stressed that we should intensify counter- and cross-cyclical adjustments through macro policies and continue to pursue a proactive fiscal policy. It was also highlighted that the intensity of our proactive fiscal policy should be enhanced and its quality and effectiveness improved.

As mentioned, the Central Economic Work Conference underscored the need to intensify counter- and cross-cyclical adjustments through macro policies and to continue with a proactive fiscal policy. It also called for steps to enhance the intensity of our proactive fiscal policy and to improve its quality and effectiveness. These constitute a major decision made by the Central Committee of the Communist Party of China (CPC) based on a comprehensive assessment of China’s overarching strategic context and development dynamics.

I. Boosting confidence, maintaining strategic resolve, and grasping the main themes and significance of our proactive fiscal policy

Enhancing the intensity of China’s proactive fiscal policy will require better coordination of fiscal resources and a combination of policy instruments, including deficits, special-purpose bonds, ultra-long-term special government bonds, preferential tax and fee policies, and government subsidies, in order to maintain an appropriate level of spending

First, we will optimize the mix of policy instruments to increase fiscal spending. A ceiling of 3.9 trillion yuan has been set for new special local government debt. We will appropriately extend the list of areas to which funds from the sale of special-purpose bonds can be channeled, as well as the scope for using such funds as project capital. Funds will be weighted toward regions where projects are well prepared and investments are made efficiently. A total of one trillion yuan of ultra-long-term special government bonds will be issued, to be used for implementing major national strategies and building security capacity in key areas. Furthermore, we will ensure carryover funds from the issuance of additional government bonds in 2023 are put to good use by enhancing oversight over the distribution, release, and use of such funds to see tangible progress being delivered as soon as possible. The deficit-to-GDP ratio has been set at 3% for the year, remaining at a relatively high level and bringing the total government deficit to 4.06 trillion yuan. In the central government budget, 700 billion yuan has been earmarked for investment. Steps will also be taken to improve both the mix and performance of government investment. Second, we will enhance transfer payments to local governments to provide them with greater fiscal support. Central government transfer payments to local governments will be kept at an appropriate level, reaching 10.2 trillion yuan. Excluding one-time special transfer payments made in both 2023 and 2024, this figure represents an increase of 4.1%. In accordance with the reform of fiscal systems at and below the provincial level, we will optimize the distribution of fiscal resources to channel more funds toward lower-level governments, so as to boost local capacities for high-quality development. Third, we will make tax and fee policies more targeted and effective. Considering the need for macro regulation, fiscal sustainability, and improved taxation, we will carry out policies on structural tax and fee reductions with a focus on supporting scientific and technological innovation and manufacturing. To further regulate the management of non-tax revenues, we will enforce a strict prohibition on arbitrary fees, fines, and charges.

Improving the quality and effectiveness of the proactive fiscal policy will require fiscal management that is based on the rule of law, sound practices, and standard procedures, as well as efforts to deliver better value for money through policy synergy

Expenditure in the national general public budget is projected to be 28.55 trillion yuan. Considering the magnitude of this spending, even minor enhancements in management will lead to further gains in efficiency. It is imperative that Party and government bodies become accustomed to keeping their belts tightened. Efforts should be made to improve the structure of government spending. While using limited new resources well, we will also devote greater energy to adjusting spending to make the best use of existing funds and strengthen fiscal guarantees for the country’s major strategic tasks and people’s basic wellbeing. To improve the effectiveness of fiscal policy, we will strengthen performance-based budget management. We will ensure that budgets are compiled based on specific objectives, their implementation is subject to oversight, assessments are conducted on their completion, assessment results are fed back to relevant departments, and feedback is well taken in practice. We will keep government finances in good order and continue to improve the efficiency of fiscal resource allocation and the performance of government funds. We will conduct further fiscal capacity assessments and coordinate fiscal policy with monetary, employment, industrial, regional, sci-tech, environmental protection, and other policies to ensure that the orientation of macro policies remains consistent.

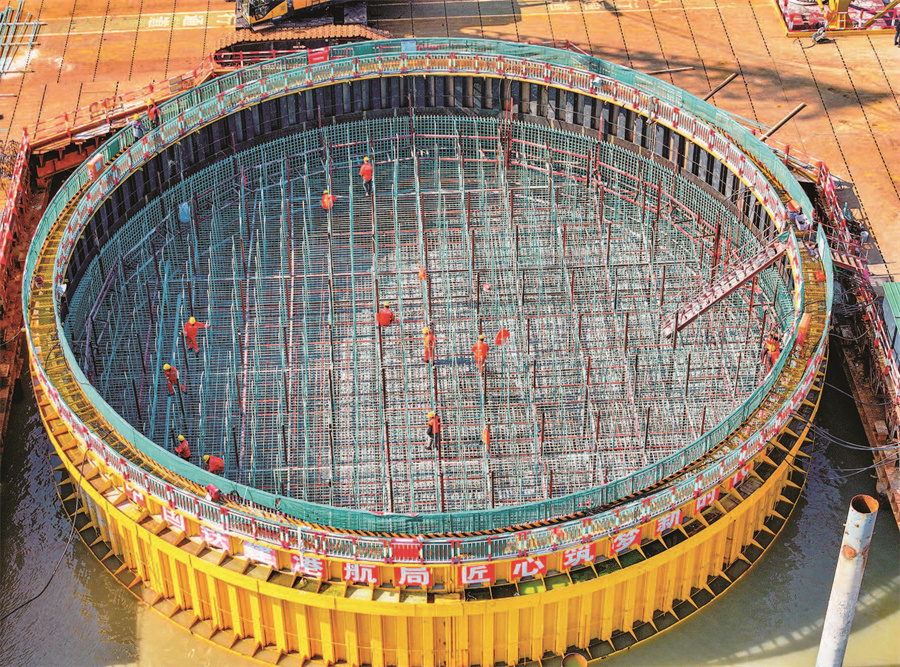

Construction workers tie rebar on a bearing platform at the construction site on the Fodu Island side of the Shuangyumen Bridge, which is part of phase two of the Ningbo-Zhoushan Port Liuheng Highway and Bridges project, February 14, 2024. The financial department has optimized expenditure structures to boost investment in major construction projects such as this one. PEOPLE’S DAILY / PHOTO BY YAO FENG

II. Supporting high-quality development with more robust funding and policy guarantees

Supporting the modernization of the industrial system

We will adopt a package of measures to coordinate the advancement of new industrialization and promote the development of new quality productive forces based on specific conditions. We will effectively utilize special funds for rebuilding industrial foundations and promoting high-quality development of the manufacturing sector. We will also provide stronger guarantees for major R&D plans and development programs in manufacturing. These efforts will enable us to bolster the resilience and security of industrial and supply chains. We will carry out policies on additional tax deductions for R&D costs to support the development and digitalization of small and medium enterprises that use special and sophisticated technologies to produce novel and unique products. Such steps will help boost enterprises’ capacity for innovation. We will implement the compensation policy concerning insurance for the initial application of newly-developed technological equipment and new materials, so as to spur the innovation and application of key products. Giving play to the role of government investment funds, we will use market-based approaches to guide the participation of nongovernmental capital in key manufacturing sectors.

The beauty of the golden rapeseed fields is enhanced by the surrounding villages, mountains, and waters in Xiangping Village, Tongdao Dong Autonomous County, Hunan Province, March 9, 2024. The financial department is working to refine a diverse range of investment mechanisms in order to accelerate the modernization of agriculture and rural areas and promote rural revitalization. PEOPLE’S DAILY / PHOTO BY TIAN QIZHEN

Working to build China’s self-reliance and strength in science and technology

Remaining focused on basic research, applied basic research, and national strategic sci-tech tasks, we must always prioritize funding support for science and technology. The central government has earmarked 370.8 billion yuan for science and technology endeavors this year, an increase of 10%. This allocation includes 98 billion yuan for basic research, an increase of 13.1%. We will refine the system for mobilizing resources nationwide to secure new breakthroughs in core technologies in key fields, support the implementation of major national science and technology projects, and facilitate major advances by encouraging cooperation among national research institutes, advanced-level research universities, and leading high-tech enterprises. To adapt to the new leadership and management systems for science and technology initiatives, we will continue to reform the mechanisms for allocating and using government research funds. We will also support efforts to train, recruit, and make the best use of talent across all sectors and boost the support available to young scientists and engineers.

Making great efforts to promote rural revitalization

We will refine a diverse range of investment mechanisms with a view to accelerating the modernization of agriculture and rural areas. This year, expenditure in the national general public budget on agriculture, forestry, and water conservancy will reach 2.53 trillion yuan, an increase of 5.1%. We will boost investment support for the development of high-standard cropland, do more to support agricultural science, technology, equipment, and services, and strengthen capacities to ensure food security. We will improve the mechanisms for ensuring the incomes of grain growers and compensating main grain-producing areas and move ahead with the nationwide roll-out of the full-cost insurance and income insurance schemes for the three main grain crops of rice, wheat, and corn. The central government has earmarked 54.5 billion yuan in subsidies for agricultural insurance premiums, an increase of 18.7%. It is also expanding its follow-up rural revitalization assistance fund to 177 billion yuan in a push to support the development of industries that will enable farmers to achieve prosperity. Industrial revitalization serves as a central pillar of the rural revitalization agenda. With this in mind, we will support local governments in developing national modern agro-industrial parks and clusters of leading agro-industries. We will grant government rewards and subsidies for developing public-interest programs in rural areas and encourage the participation of rural residents in rural development endeavors.

Promoting integrated urban-rural development and coordinated regional development

We will improve the systems and mechanisms for integrated urban-rural development and regional cooperation and mutual assistance, in a bid to generate more extensive and effective flows in the domestic economy. Local governments will receive support to move faster in granting urban residency to people from rural areas, with the central government allocating a 40-billion-yuan award fund for this purpose. These funds will facilitate more equitable access to basic public services for these new residents, ensuring they have stable employment and housing guarantees and their children who have moved to the city with them have access to education. In providing support for urban renewal initiatives, we will seek to advance three major projects—government-subsidized housing, public infrastructure designed for both regular and emergency use, and the reconstruction of urban villages. We will improve fiscal and tax policies for supporting regional development strategies and provide greater support to old revolutionary base areas, areas with large ethnic minority populations, and border areas.

Advancing ecological conservation

We will fulfill our commitment to the principle that lucid waters and lush mountains are invaluable assets by providing a significant level of funding for building a Beautiful China. This year, the central government has allocated 65.1 billion yuan for the prevention and control of air, water, and soil pollution. These funds will be used to support the use of clean energy sources for winter heating in northern China, step up efforts to address water pollution with a focus on the Yangtze and Yellow rivers, and strengthen the prevention and control of soil pollution at the source. The central government will also launch special subsidies to support the shelterbelt program for northeast, north, and northwest China.

We will steadily implement projects for the integrated conservation and restoration of mountain, water, forest, farmland, lake, grassland, and desert ecosystems and develop the national park-based nature reserve system. Steps will be taken to align tax and fiscal policy systems with China’s carbon peaking and neutrality goals and to refine the mechanisms for compensating ecological protection and realizing the market value of ecological goods and services.

III. Acting on the people-centered development philosophy to ensure and improve people’s wellbeing through development

Underscoring our employment-first orientation

To expand employment, we will enhance coordination between fiscal and tax policies on the one side and employment policies on the other. The central government has set aside 66.7 billion yuan for employment subsidies, which will be used to support different regions in implementing policies to support employment and entrepreneurship, with a focus on employment for key groups such as college graduates and rural migrant workers. We will use a combination of policies, including loan interest subsidies, tax and fee cuts and exemptions, and subsidies for business start-ups, to help enterprises stabilize and expand payrolls and individuals secure employment or start businesses through various avenues. Support will be provided for the implementation of vocational skills training programs on a large scale to better meet the demand for well-trained personnel in advanced manufacturing, modern services, and elderly care.

Boosting the development of a high-quality education system

The mechanism for government spending on education will be refined. This year, expenditure on education in the national general public budget will amount to 4.29 trillion yuan, accounting for 15% of total general public budget expenditures. Using various channels, we will strive to ensure more resources for public-benefit preschool education and expedite high-quality, balanced development and urban-rural integration in compulsory education. Work to improve conditions in regular senior secondary schools at the county level will be strengthened. We will also look into establishing an academic discipline-based system to provide differentiated funding to vocational schools on a per-student basis. We will ramp up efforts to develop world-class universities and leading disciplines with Chinese features, with support weighted toward the reform and development of advanced-level research universities. To help ease the educational burden on families in difficulty, a total of 72.3 billion yuan will be allocated for student financial aid in the central government budget.

Bolstering the capacity of medical and health care services

For further reform of medical and health care systems, we will promote the coordinated development and management of medical insurance, medical services, and pharmaceuticals. This year, 2.28 trillion yuan has been allocated for health care expenditures in the national general public budget. We will increase government subsidies for basic medical insurance for rural and non-working urban residents by 30 yuan per person, bringing the annual total to 670 yuan per person. We will advance the unified management of basic medical insurance funds at the provincial level and enhance regulation of medical insurance funds. Government subsidies for basic public health services will rise to 94 yuan per person per year, to be used for improving the public health system. We will deepen the reform of public hospitals to see that they better serve the public interest and make high-quality medical resources more widely available by channeling them toward the community level and ensuring a more balanced distribution across regions.

Students send their kites soaring skyward at Shajing Primary School, Guanyindong Town, Guizhou Province, March 6, 2024. Fiscal policy for 2024 is focused on solving pressing difficulties and problems that concern the people most. These efforts include supporting the development of high-quality education by refining the mechanism for government spending. PEOPLE’S DAILY / PHOTO BY ZHOU XUNCHAO

Improving the social security system

This year, 4.14 trillion yuan has been allocated for expenditures on social security and employment in the national general public budget. We will intensify efforts to bring basic old-age insurance funds for enterprise employees under unified national management and continue to raise basic pension benefits for retirees. The minimum basic old-age benef its for rural and non-working urban residents will increase by 20 yuan per month, and related central government transfer payments to local governments will rise by 10.6%. To accelerate the development of a multi-tiered, multi-pillar old-age insurance system, we will push ahead with establishing a nationwide private pension system. We will guide localities in improving mechanisms to ensure sufficient funding for basic elderly care services and support the provision of catering services for seniors, as well as centralized care for functionally impaired seniors in financial difficulty. We will refine supporting policies on childbirth and facilitate the development of public-benefit childcare services. We will take steps to determine the appropriate level of subsidies and living allowances to be received by entitled groups and improve the multi-tiered and category-based social assistance scheme.

Promoting the development of cultural programs

We will support the integrated development of urban and rural public cultural services to expand their reach and better adapt them to specific needs. To strengthen the protection and utilization of cultural relics and better preserve and carry forward our intangible cultural heritage, we will support efforts to carry out the fourth national survey of cultural relics. We will improve the operating mechanisms for dedicated funding for culture and the arts, so as to encourage the creation of more outstanding works. To promote extensive fitness-for-all activities, we will support public sports facilities in opening their doors to the public free of charge or for a small fee.

IV. Ensuring both development and security and facilitating steady and sustainable fiscal operations

Providing solid guarantees for the three priorities

The basic function of public finance is to guarantee three priorities: the people’s basic wellbeing, payment of salaries, and normal government functioning at the local level. Over recent years, the Ministry of Finance has put in place a sound system to ensure the three priorities. As a result, fiscal operations are now largely stable at the county level, although certain regions still face considerable pressure in this respect. Governments at all levels must keep the three priorities high on the agenda and ensure essential funding for these items. To see that each level fulfills its responsibilities, we will improve the system whereby county-level governments assume primary responsibility, prefecture-level governments provide assistance (and in some cases ensure basic needs are met), provincial-level governments ensure basic needs are met, and the central government provides incentives. Management and working mechanisms will also be improved to promote lateral coordination between responsible departments and vertical linkages between different levels of government. This year, central government transfer payments to local governments for ensuring equal access to basic public services will reach 2.57 trillion yuan, an increase of 8.8%. Under the mechanism for ensuring basic funding for county-level governments, transfer payments in the form of rewards and subsidies will come to 446.2 billion yuan, an increase of 8.6%. These increases represent a further rise in fiscal support for local governments. When compiling budgets, local governments should give first consideration to the three priorities, ensuring sufficient funds are allocated for related expenditures. Management over the execution of related expenditures will be bolstered. Leveraging integrated budget management systems, we will step up dynamic oversight of related fiscal operations and provide timely notice and warning of risks so that they can be appropriately handled in accordance with laws and regulations.

Preventing and defusing local government debt risks

China’s hidden debt level is steadily declining, and local government debt risks are, on the whole, controllable. Giving consideration to both immediate and long-term needs and targeting both symptoms and root causes, finance departments need to work in collaboration with relevant stakeholders to swiftly establish government debt management mechanisms that are adapted for high-quality development. This way, risks can be gradually resolved in the course of pursuing high-quality development. Building on our recent success in resolving debts, we will advance the implementation of a suite of debt resolution measures and urge localities to fulfill their primary responsibility by making every effort to defuse debt risks.

V. Furthering reform and strengthening management to improve fiscal governance

Fulfilling the requirement for Party and government bodies to get used to keeping their belts tightened

At the Central Economic Work Conference last year, it was stressed that Party and government bodies must get used to keeping their belts tightened, as this requirement will remain in place over the long term. Every cent saved in the running of Party and government bodies can be used to better ensure the wellbeing of our people. Finance departments should regard belt-tightening as a long-term policy and see that all departments and organizations fulfill this requirement in practice. Budget controls will be tightened up, audit mechanisms for expenditures will be improved, and management over spending on official overseas visits, official vehicles, and official hospitality will be enhanced. We need to realize a further reduction in spending on forums, exhibitions, and similar events and keep general expenditures under strict control. Spending on obligatory items must also be firmly kept in check. This requirement will apply to project spending, asset management, government procurement, and administrative management to ensure frugality in all affairs. Assessments will be carried out on adherence to belt-tightening requirements, and we will conduct rigorous oversight and resolutely investigate and strictly deal with any problems in this respect. We will take resolute steps to prevent both vanity and prestige projects.

Improving fiscal management

We must put a clear focus on improving fiscal management, ensuring it is based on the rule of law, sound practices, and standard procedures. We will refine the system of laws and regulations for fiscal management, regulate the allocation and management of funds and the level of discretion allowed in policy formulation and implementation, and employ rule-of-law thinking and methods to advance our work. With a focus on the CPC Central Committee’s decisions and plans, we will conduct comprehensive lifecycle evaluations of major fiscal and tax policies, so as to enhance the precision and effectiveness of these policies. We will ensure that all departments and organizations fulfill their responsibility for ensuring budgets are complete, up to standard, and genuine and that the determined outcomes are delivered in their execution. We will establish an expenditure standards system across the board and improve the mechanisms for evaluating projects to be included in the project repository and their ongoing management. We will intensify efforts to boost the transparency of budget proposals and final accounts by increasing the scope and detail of information available to the public and taking major steps to increase the transparency of fiscal policies. We will use digital and information technologies to support fiscal management and improve the integrated budget management system to ensure no misuse or waste of funds.

Stepping up oversight of accounting

Accounting oversight is one of the important functions delegated to the Ministry of Finance by the CPC Central Committee. The Regulations of the Communist Party of China on Disciplinary Action incorporate violations of national fiscal discipline within the scope of the Party’s disciplinary action. This has imposed higher demands on the oversight of accounting. We will fully implement the Guidelines on Further Strengthening Oversight on Accounting, refining the system and working mechanism for accounting oversight and stepping up oversight over public finance, fiscal work, and accounting activities of state bodies, enterprises, and public institutions in line with relevant laws and regulations. To increase the cost of breaking the law, we will push forward the work of revising regulations on penalties for fiscal violations, as well as the Accounting Law and the Certified Public Accountants Law. We will carry out dedicated accounting oversight initiatives, taking tougher action against activities that violate laws and regulations and tightening up fiscal discipline. We will also work to bolster, refine, and optimize the functions of supervision bureaus under the Ministry of Finance, improving closed-loop management and boosting the quality and efficiency of oversight. Coordination will be improved between oversight in the domain of accounting and other spheres so as to generate synergy in oversight work.

Planning a new round of fiscal and tax system reform

Reform of the fiscal and tax systems will be continued. Reform will be advanced in line with the requirements for Chinese modernization and high-quality development, the principle of sharing tax revenues between the central and local governments, and the achievements secured in finance and tax reform since the 18th CPC National Congress in 2012. We will look into ways to improve the modern budgeting system, so as to make budgets more complete, improve the allocation of fiscal resources, and strengthen financial support for major strategic plans. Keeping the overall tax burden and tax framework stable, we will look into improving the taxation structure, refine the local tax system, improve environment-related taxation, and move forward with non-tax revenue reform. We will also improve the transfer payments system, studying ways to establish incentive and constraint mechanisms for transfer payments that will help promote high-quality development. We will look into improving the fiscal system, accelerate reform of fiscal systems below the provincial level, and improve the systems for ensuring fiscal powers are commensurate with expenditure responsibilities.

Lan Fo’an is Minister and Secretary of the CPC Leadership Group, Ministry of Finance.

(Originally appeared in Qiushi Journal, Chinese edition, No. 6, 2024)