Chinese, foreign enterprises forge closer partnerships in NEV industry

* A huge market, a complete industrial chain, continuous innovation, and supportive policies have driven Chinese and international partners to strengthen cooperation and share opportunities in the NEV industry.

* China remains the most promising market for the global automotive industry, especially in the NEV market.

* From mere suppliers to R&D and joint venture partners, Chinese and international companies are becoming more intertwined in the industrial chain than ever before.

HEFEI -- In May this year, Chinese automaker Chery launched a new energy vehicle (NEV) with a driving range exceeding 2,000 kilometers, featuring some tires supplied by German tire manufacturer Continental AG.

Since 2019, the two companies have worked in cooperation to explore the NEV market. Their partnership exemplifies the growing integration between Chinese and foreign companies in the NEV industry, encompassing production cooperation, stake acquisitions, and market expansion both domestically and internationally.

Staffers from German tire manufacturer Continental AG and Chinese automaker Chery discuss the cooperation of new energy vehicle (NEV) tires in Wuhu, east China's Anhui Province, May 15, 2024. [Xinhua/Wang Haiyue]

These closer partnerships come as an increasing number of foreign companies in the industry seek to capitalize on the booming market.

SHARING OPPORTUNITIES

China has been the world's top NEV producer and seller for nine consecutive years. Data from the China Association of Automobile Manufacturers shows that in 2023, China's production and sales of NEVs exceeded 9.587 million units and 9.495 million units, respectively, both accounting for over 60 percent of the global total.

A huge market, a complete industrial chain, continuous innovation, and supportive policies have driven Chinese and international partners to strengthen cooperation and share opportunities in the NEV industry.

"The development of the NEV industry features innovation across industries and fields, as well as more open and inclusive international cooperation," said Tao Min, head of operation at Continental Tires (China) Co., Ltd., the first wholly-owned tire production base of Continental AG in China.

China remains the most promising market for the global automotive industry, especially in the NEV market, Tao said.

Continental Tires' partnerships extend to more than 10 Chinese automakers, including BYD and NIO. Its NEV tire output for this year is projected to grow by over 30 percent compared to 2023.

The NEVs of Chery, which has about 230 foreign suppliers, have gained popularity both at home and abroad. During the first five months of this year, its NEV sales hit 135,861 units, up 168.9 percent year on year.

Acknowledging China's burgeoning innovation in NEVs, Volkswagen has established deep ties with Chinese companies including electric vehicle maker XPENG and Horizon Robotics, an intelligent driving technologies provider.

A drone photo taken on June 7, 2024 shows an exterior view of Volkswagen (Anhui) Automotive Company Limited in Hefei, east China's Anhui Province. [Xinhua/Guo Chen]

"Through the partnership with XPENG, we are not only accelerating development times, but also boosting efficiency and optimizing cost structures," said Ralf Brandstätter, chairman and CEO of Volkswagen Group China. He added that the two sides are working closely to combine their strengths to bring smart products onto the road.

Foreign automakers need China's advanced electrification technology to achieve the "in China, for the world" strategy while Chinese automakers and suppliers need to promote internationalization with foreign companies as a platform, said Gao Debu, a professor at Renmin University of China.

Such deep cooperation is increasingly common in China's NEV sector. BMW has established partnerships with Chinese battery producer CATL and automaker Great Wall Motor.

NEW COOPERATION MODEL

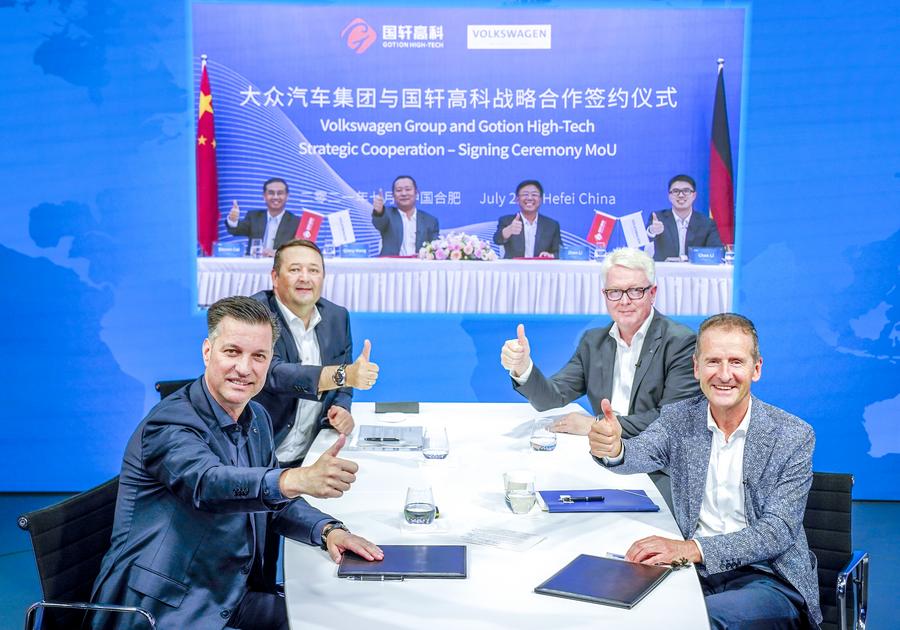

A new cooperation model emerged two years ago when Ralf Lorenz from Volkswagen became the chief purchasing officer of Chinese battery maker Gotion High-tech, taking responsibility for industrial chain management. "This kind of stationed working mode can be said to be a brand-new attempt of the cooperation mode between Volkswagen and suppliers," Ralf said.

This photo taken on July 2, 2021 shows a signing ceremony of strategic cooperation between Chinese battery maker Gotion High-tech and Volkswagen Group, in Wolfsburg, Germany. [Gotion High-tech/Handout via Xinhua]

In 2020, Volkswagen Group (China) announced to invest 1.1 billion euros in Gotion High-tech to become its largest shareholder. Over the years, Volkswagen has sent three senior executives to Gotion High-tech and the two parties have formed a joint project team with over 100 employees.

From mere suppliers to R&D and joint venture partners, Chinese and international companies are becoming more intertwined in the industrial chain than ever before.

Industry insiders believe that deep integration can help further optimize the allocation of various production factors and promote the development of the global NEV industry.

The establishment of Anhui Cummins, a joint venture between Chinese carmaker JAC Group and American engine manufacturer Cummins Inc., is a testament to the closer partnerships.

This undated file photo shows a workshop of Anhui Cummins, a joint venture between Chinese carmaker JAC Group and American engine manufacturer Cummins Inc., in Hefei, east China's Anhui Province. [Anhui Cummins/Handout via Xinhua]

With support from JAC, Cummins has enhanced its research and development capabilities in medium and light-duty engines, while JAC has increased vehicle exports by leveraging Cummins' global network. The two have also been jointly developing NEV-related products.

"The establishment of the joint venture is more about recognizing the core values of both sides, with the ultimate purpose of achieving successes in the respective fields," said Rick Bai, general manager of Anhui Cummins Power Co., Ltd.

SHARED FUTURE

According to the International Energy Agency, the global demand for NEVs is expected to triple to 45 million units by 2030, while the demand for power batteries will quadruple to 3,500 GWh.

Capitalizing on its technological and industrial chain advantages, China is attracting global NEV enterprises to establish subsidiaries in the country, thereby contributing to the building of a stable and efficient global industrial chain.

This photo taken on May 13, 2024 shows an exterior view of the Volkswagen College of Hefei University in Hefei, east China's Anhui Province. [Xinhua/Guo Chen]

In March, a joint venture between Mercedes-Benz Group China Ltd. and BMW Brilliance Automotive Ltd. was established in Beijing, with plans to build at least 1,000 supercharging stations across China by 2026.

In May, Tesla broke ground on a mega factory in Shanghai to manufacture its energy storage batteries. Volkswagen has announced plans to launch at least 30 purely electric models in China by 2030.

"In the future, our batteries produced in Europe will mainly supply European car companies including Volkswagen," said Wang Qisui, president of the China Business Segment of Gotion High-tech.

This undated file photo shows a workshop of Chinese battery maker Gotion High-tech in Hefei, east China's Anhui Province. [Gotion High-tech/Handout via Xinhua]

Wang added that the company may expand its collaboration with Volkswagen in the field of energy storage in the future, rolling out more new energy applications to contribute to global efforts towards carbon neutrality.

Reporting by Liu Jing, Yang Yuhua, Wang Haiyue, He Xiyue, Guo Chen, Ma Xinran, Li Baojie; video reporters Liu Jing, Guo Chen, He Xiyue, Wang Haiyue, Ma Xinran; video editors: Zhang Qiru; Yin Le, Wang Houyuan, Zhang Yichi